According to Greater Vancouver Realtors (GVR), there were 1,827 home sales in Metro Vancouver in February 2025. That’s about 11.7% fewer sales than in February 2024, when 2,070 homes sold. It’s also nearly 29% lower than the average number of sales for this time of year over the past decade (2,571).

“After the rush of new listings in January, home sales and new listings in February were closer to historical averages, which has positioned the overall market in balanced conditions,” Andrew Lis, GVR’s director of economics and data analytics said. “With a potential Bank of Canada rate cut on the table for mid-March, homebuyers may find slightly improved borrowing conditions while enjoying the largest selection of homes on the market since pre-pandemic times.”

In February 2025, 5,057 homes—including detached houses, townhomes, and condos—were newly listed for sale on the MLS. That’s about 11% more than the 4,560 listings in February 2024 and roughly 12% higher than the 10-year average for this time of year.

Currently, there are 12,744 homes available for sale in Metro Vancouver. That’s a 32% increase from last year (9,634 listings) and 36% higher than the 10-year seasonal average (9,341).

When we look at sales versus active listings, the market is sitting at a 14.8% ratio overall. Broken down by property type, detached homes are at 10.7%, townhomes at 18.5%, and condos at 16.8%.

Historical data suggests that sustained ratios below 12% exert downward pressure on home prices, while those exceeding 20% over several months typically lead to upward price trends.

“Balanced market conditions typically bring a flatter price trajectory, and we’ve seen prices across all segments remain in a holding pattern for the past few months,” Lis said. “But with the active spring season just around the corner, it will be interesting to see whether buyers take advantage of some of the most favorable market conditions seen in years, and whether sellers change their willingness to bring their properties to market.”

Right now, the average home price in Metro Vancouver is $1,185,100. That’s a small 0.3% increase from this time last year and up 0.9% from last month.

Looking at different types of homes:

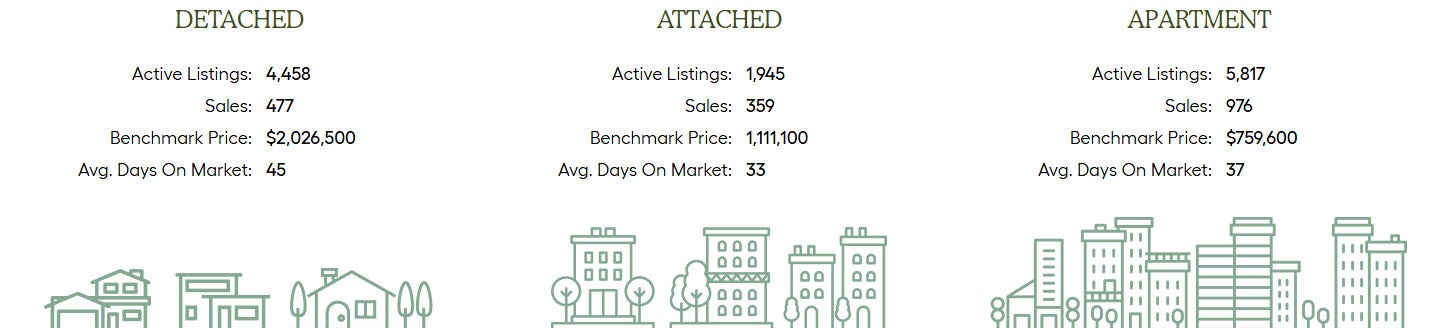

• Detached homes: 477 were sold in February 2025, which is 14.8% fewer than last year. The average price for a detached home is now $2,026,500, up 2.8% from last year and 0.8% from last month.

• Condos: 976 condos sold in February, down 10.6% from last year. The average price is $759,600, which is down 1.2% from last year but up 1.5% from last month.

• Townhomes: 359 townhomes were sold, a 10.9% drop from last year. The average price is $1,111,100, up 1% from last year and 0.5% from last month.

Overall, home prices have remained relatively stable, with slight increases in most property types compared to last month.

The Takeaway:

We have been experiencing a balanced market over the start of the 2025. As the mortgage rates have been dropping, the buyers that were waiting on the sidelines in fear of them rising have been now idly waiting to see how low they can go. The latest numbers showed a moderate increase to inflation and this may cause the Bank of Canada (BoC) to slow down on their steady decreases in the interest rate.

Traditionally the Spring market starts late March/early April after the spring break and this will likely be the same. There are two schools of thought on if the tariffs installed by the U.S.:

Traditionally the Spring market starts late March/early April after the spring break and this will likely be the same. There are two schools of thought on if the tariffs installed by the U.S.:

- That they will cause Canada to implode and with it the residential home market will crash as everyone will be unemployed and thus not be able to purchase a home nor stay in the one they are currently occupying.

- That while there will be many job losses, that this will affect those that do not have as many resources greater than those that do; much like the effect we saw during the Covid-19 lockdowns.

I personally am in the second camp as those that have more resources for home ownership will likely be less affected by the trade war than those on the cusp.

Overall I suspect we will quite a bit of action in the market and if you are thinking to purchase, moving on that sooner than later would be your best move as once the market kicks off, we will likely return to a higher paced market and the return of multiple offer situations.

If you would like to have to some real world advice about how to navigate the current market and plan for the future call or text me at 604-522-4777 or e-mail directly at: haze@hazerealtor.com or join us at our Facebook Page (www.facebook.com/HazeRealtor) and we see what the best move can be.